Special report – China Published on

Special report – China 🇨🇳

Live from the Market

2023 was the year of transition for epidemic prevention and control in China. During this initial economic recovery phase, overall textile and clothing exports fell, with cotton products having the greatest drop and chemical fiber products becoming the main export products. Despite the downturn in traditional export markets, there was a surge in cross-border e-commerce, penetrating regions like Southeast Asia, Europe, and the United States via platforms like TikTok. Notably, women’s clothing and lingerie stood out as key products.

Exports of cotton products declined

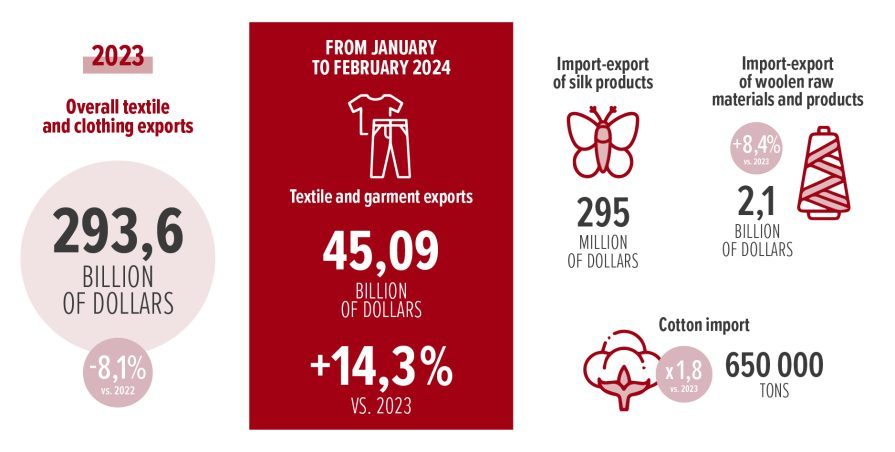

China’s overall textile and clothing exports in 2023 were US$293.6 billion, representing an 8.1% decline from the previous year. From January to February 2024, China’s textile and garment exports totaled US$45.09 billion, a 14.3% increase year on year. Textile exports increased by 15.5% to US$21.71 billion, while garment exports increased by 13.1% to US$23.38 billion. It is worth mentioning that the export volume from January to February far exceeded the US$38.155 billion recorded in 2019 prior to the outbreak, although it has yet to approach the level of the same period seen in 2022.

According to China Customs data, between January and February 2024, the total import and export value of silk products remained at US$295 million compared to the previous year. The total import and export value of woolen raw materials and products reached US$2.1 billion, marking an 8.4% increase year-on-year. Specifically, exports amounted to US$14.8 billion, up by 5% year on year, while imports stood at US$610 million, reflecting a 17.5% increase year on year. Notably, wool imports surged by 32.8% to 51,000 tons, although the unit price decreased by 6.2% to US$6.59/kg.

Cotton imports soared to 650,000 tons, a 1.8-fold increase year-on-year, while cotton yarn imports rose by 60% to 240,000 tons. Some cotton mills have been facing a shortage of orders, affecting production ranging from fabrics to clothing. Additionally, the capacity utilization rate of certain coastal knitting yarn mills has been suboptimal. A recent survey in March 2024 revealed that the overall capacity utilization rate was 79.7%, marking an 8.8% decrease from the previous month.

Functional fabrics and “neo-Chinese style” fabrics are selling well

Since April 2020, the Chinese government has determined to “build a new development pattern with domestic circulation as the mainstay and domestic and international circulations reinforcing each other.” Since then, the domestic circulation approach has proven to be highly effective for the textile and clothing industry. As per the Statistical Communiqué of the People’s Republic of China on the 2023 National Economic and Social Development from the National Bureau of Statistics of China, there was a 12.9% increase in clothing, shoes, hats, and knitted textiles. The annual retail sales of these items amounted to RMB1.4 trillion, marking a 12.9% year-on-year growth. National online retail sales of clothing products rose by 10.8% from the previous year and by 7.3% from 2022.

The structure of fashion consumption has undergone significant changes. Price sensitivity has increased, while attention to well-known brands, especially overseas ones, has decreased. A noticeable trend is the growing popularity of clothing and fabrics with Chinese cultural characteristics. For example, the sales of Hanfu (Han-style clothing) such as Mamianqun (horse-face skirts) have achieved explosive growth, including jacquards and brocades with traditional patterns, and certain fabrics incorporating traditional handicrafts.

Plant-dyed cotton and linen fabrics, for example, are in high demand, and the businesses engaged have a wide range of offerings, particularly for young women’s, adult women’s, and children’s clothes. The surge in the “neo-Chinese style” market has propelled the growth of associated industries.

In addition, a key aspect of clothing brands sold in the domestic market in 2023 is their focus on functionality. Traditional local brands excel in sports and down jacket categories, whereas newer vertical brands also prioritize sports and cold protection. With a focus on creating standout products, these brands have a dedicated approach to research and development, leading to the popularity of functional fabrics like sun protection and thermal insulation fabrics.

Extensive sustainability primarily involves adjusting production and sales processes

Online sales of local brands account for a significant portion of total sales, particularly as sales expand on social media platforms like Douyin. Online pre-sales, big data analysis, and other methods can effectively control inventory, addressing the major issue of deadstock in the textile and clothing industry to some extent. This approach stands out as the most widely adopted and effectively applied sustainable practice in China’s textile and clothing industry. Meanwhile, environmentally conscious mid-to-high-end brands using eco-friendly materials and manufacturing processes are gradually attracting consumer interest in a subtle manner. Key products include cotton, linen, wool, silk, and functional fabrics.

In 2024, China’s textile and clothing industry will face numerous uncertainties in both local and international trade. Various countries’ policies will influence exports. Domestic customer desires have not been sufficiently boosted for the time being. This is also a significant reason why functional clothing and materials have gained popularity. Essential apparel capable of addressing practical needs has somewhat supplanted aesthetic considerations, capturing the attention of a broader consumer base.

By Wendaomi, April 16th 2024

Ones to watch (very) closely…

Discover our selection of brands making waves on the Chinese market

The eye of Tranoï

Tranoï, the trade show partner specializing in young international designers, shares its pick of emerging Chinese-based brands to follow

ARYA

Ready-to-wear / knitwear

Arya: Redefining pure luxury and effortless elegance.

Born in China, Arya is steeped in the artisanal know-how of ancient Oriental beauty. We meticulously select high-quality natural materials, embracing an outlook based on ” bravado, independence, strength and cool-headedness”. We integrate sustainable thinking into our products, to create exquisite high-end knitwear for women looking for a high quality lifestyle, redefining pure luxury and effortless elegance.

OOAK

Accessories / Jewelry

OOAK is a comprehensive platform revolving around the idea of ” jewelry with style”. OOAK was founded in 2012 by Alice Xu to share her love of fashion jewelry and design. China’s first multi-brand boutique specializing in designer jewelry, OOAK, which is short for “One of a Kind”, scours the globe to bring together a handpicked selection of both established and emerging designers. Over the years, OOAK has earned a reputation as “the best jeweler” in China.

In early 2017, OOAK embarked on a new journey with its eponymous in-house jewelry line, launching OOAK into a whole new chapter.